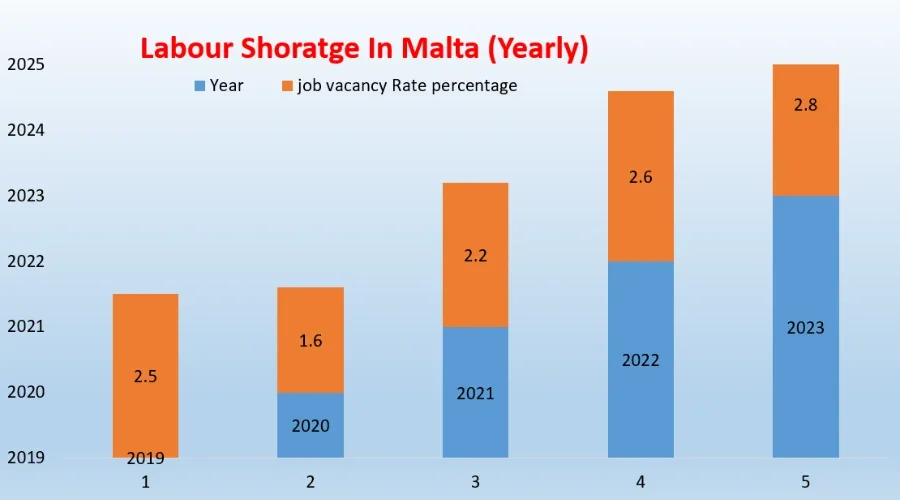

Malta’s job vacancy rate data from 2015 to 2024 shows an important story about the country’s evolving labour market. The year-wise job vacancy rates show clear shifts in labour market conditions between 2019 and 2023. In 2019, a vacancy rate of 2.5% reflected strong labour demand in a growing economy. This dropped sharply to 1.6% in 2020, indicating reduced hiring activity due to economic disruption and uncertainty. As recovery began, the vacancy rate increased to 2.2% in 2021, signalling a gradual return of employer demand.

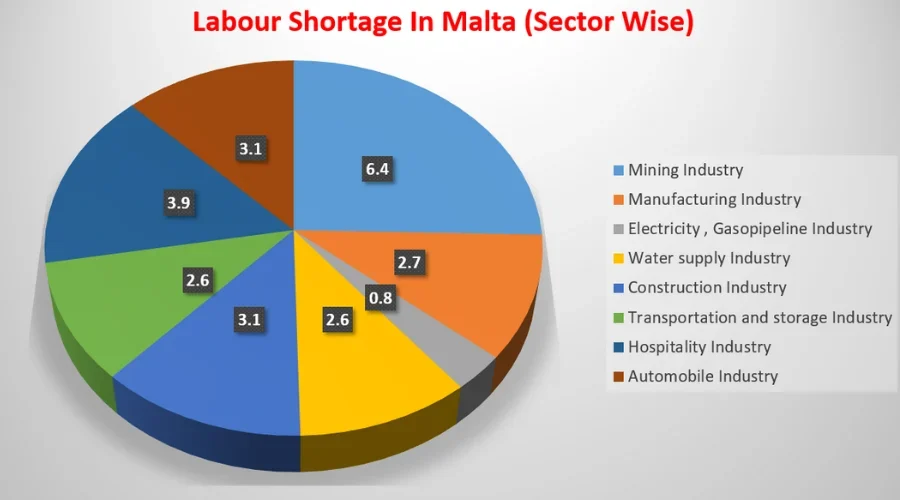

Malta faces labour shortages across major sectors. Mining leads with 6.4%, followed by hospitality 3.9%, construction and automobile 3.1%. Manufacturing, transportation, and water supply report around 2.6–2.7%, while electricity and gas show 0.8%. These shortages highlight Malta’s growing reliance on foreign workers to sustain economic and industrial growth today now. Overall, these trends highlight Malta’s strong dependence on foreign workers to sustain economic growth and maintain industrial productivity.

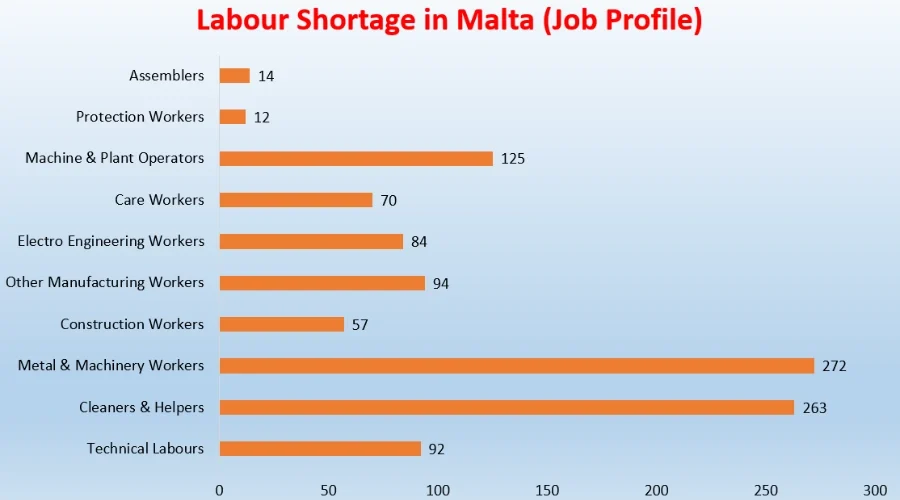

The skill-wise vacancy data for Malta highlights shortages across sectors, like Metal and machinery workers (272 vacancies) and cleaners and helpers (263 vacancies) show the highest demand, emphasizing gaps in technical and support roles. Machine and plant operators (125) and technical labour (92) also show scarcity, underlining the need for skilled personnel in industrial operations. Specialized roles, including electro-engineering workers (84), other manufacturing workers (94), and care workers (70).

We provides skilled workers across the following industries:

We provide employers with the following skilled profiles:

Flexible employment models designed for Romanian employers.

Facing labour shortages or expansion challenges in Malta?

BCM Group delivers reliable, compliant, and scalable Indian manpower solutions that support uninterrupted operations and long-term growth.

[contact-form-7 id=”d2f63f9″ title=”Candidate Form”]

[contact-form-7 id=”3b2dcad” title=”Employer Form”]

License No. MUMBAI/PARTNERSHIP/5493853/2021

HEADQUARTERS: 409, 4th floor, Amanora Chambers, Amanora Mall, Near Magarpatta City, Hadapsar, Pune – 411208

© 2024–2025 bcmgroup. All Rights Reserved.

Privacy Policy | About Us | Contact Us | Submit Your C.V | Submit Your Requirements