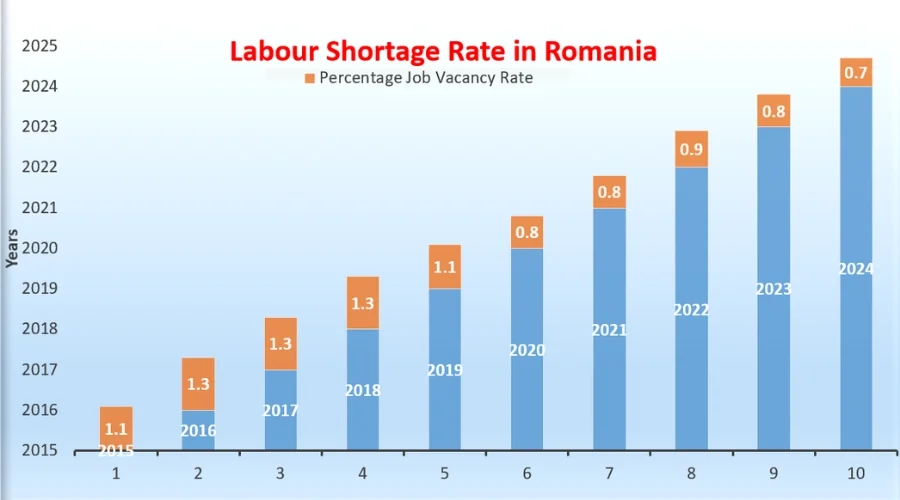

Romania’s job vacancy rate data from 2015 to 2024 shows an important story about the country’s evolving labour market. Romania’s job vacancy rate rose from 1.1% (2015) to 1.3% (2016–2018), showing growing labour demand. The rate fell after 2019, reaching 0.7% in 2024, but shortages still persist. From 2021 onward, Romania entered a phase of structural labour deficit. Even with a lower official vacancy rate, employers across key industries continue to struggle to fill positions. Employers increasingly rely on foreign workers to fill essential roles.

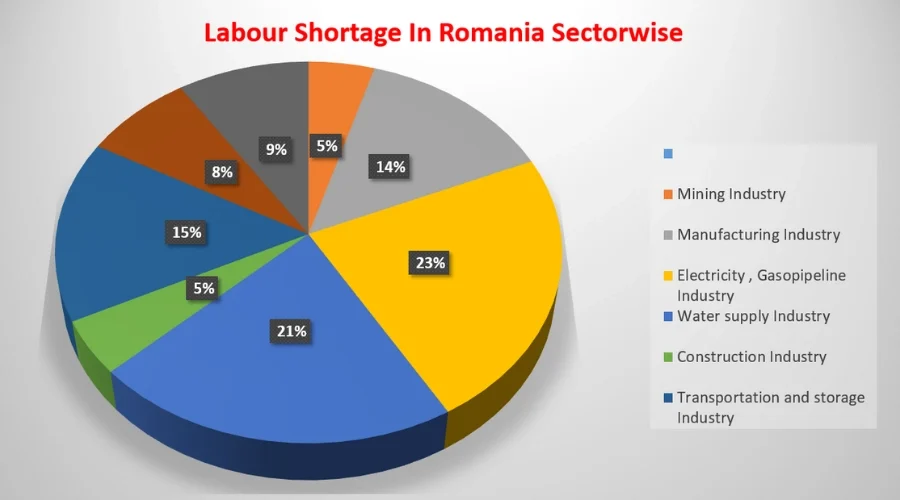

Romania faces labour shortages across key industries, according to recent Eurostat-based data. The electricity and gas sector shows the highest shortage at 23%, followed by water supply at 21%, reflecting a critical need for infrastructure technicians. Transportation and storage report a 15% gap, while manufacturing faces a 14% shortage, affecting production capacity. The automobile industry has a 9% deficit, and hospitality struggles with an 8% shortage, especially in service roles. These shortages highlight Romania’s growing dependence on foreign workforce hiring.

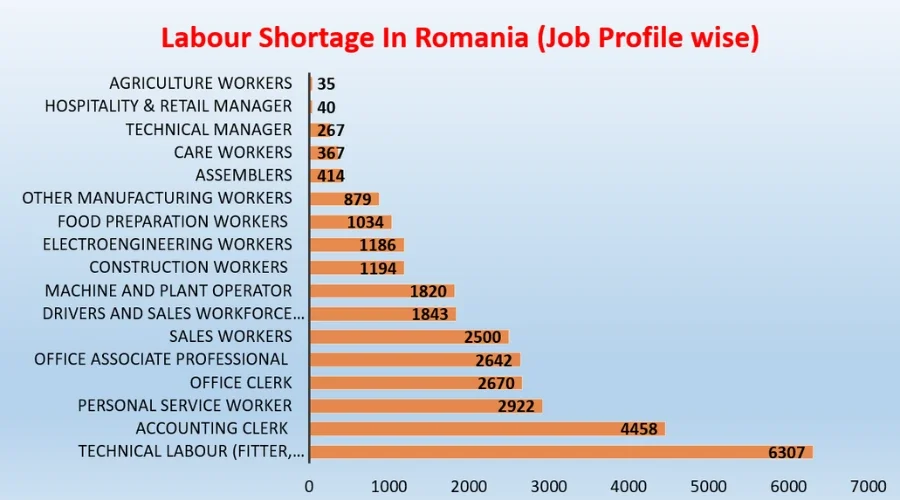

As per researched and analysed data from Eurostat, Romania faces major job vacancies across multiple occupations: Technical labour 6307, Accounting clerks 4458, Personal service workers 2922, Office clerks 2670, Office associate professionals 2642, Sales workers 2500, Drivers 1843, Machine operators 1820, Construction workers 1194, Electroengineering workers 1186, Food preparation 1034, Manufacturing workers 879, Assemblers 414, Care workers 367, These figures highlight widespread workforce shortages across both skilled and support roles.

We provides skilled workers across the following industries:

We provide employers with the following skilled profiles:

Flexible employment models designed for Romanian employers.

Each model ensures legal compliance, workforce flexibility, and operational efficiency.

Facing labour shortages or expansion challenges in Romania?

BCM Group delivers reliable, compliant, and scalable Indian manpower solutions that support uninterrupted operations and long-term growth.

[contact-form-7 id=”d2f63f9″ title=”Candidate Form”]

[contact-form-7 id=”3b2dcad” title=”Employer Form”]

License No. MUMBAI/PARTNERSHIP/5493853/2021

HEADQUARTERS: 409, 4th floor, Amanora Chambers, Amanora Mall, Near Magarpatta City, Hadapsar, Pune – 411208

© 2024–2025 bcmgroup. All Rights Reserved.

Privacy Policy | About Us | Contact Us | Submit Your C.V | Submit Your Requirements